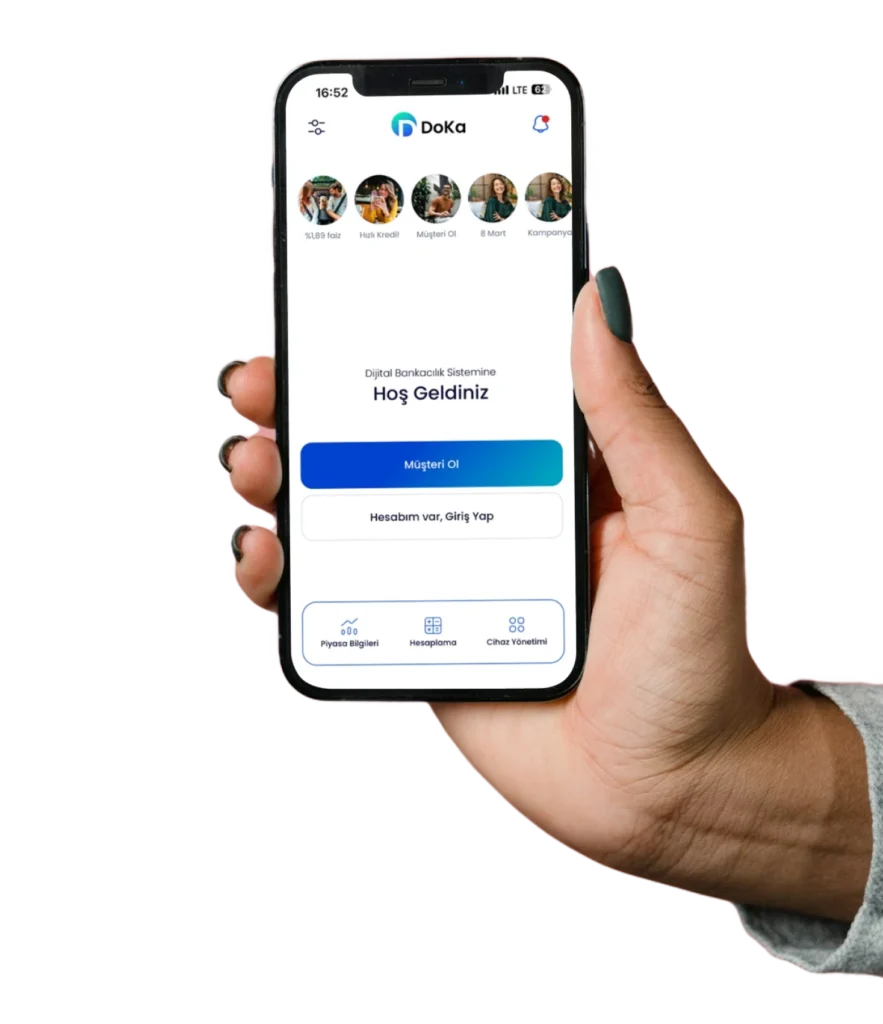

DoKa Digital Bank

DoKa is a digital banking channel solution that combines the latest technology with user-centered design to provide a personalized banking experience. Encompassing internet banking, mobile banking, call center channels, and channel management module, DoKa covers all the digital channels financial institutions need.

- Adaptable to all Core Banking systems

- Can work either Cloud and On Prem

- Enhanced user interface and experience by design means

- Includes its own channel Management module to orchestrate authorization in between Channels

- Provides highest security standards with DoKa Trust for mobile and internet banking as well as distant agreements

Overview of The Product's Content and Operation

Explore the Seamless Integration of Digital Channels and Advanced Features

Single Solution Provider for all Digital Channels;

DoKa integrates internet banking, mobile banking, and call center channels, offering a seamless and comprehensive digital banking experience.

Latest Technology

With the .NET latest technology and a user-centered design approach, DoKa ensures a personalized and user-friendly banking journey for customers.

Customer Centric Approach

With the latest technology and a user-centered design approach, DoKa ensures a personalized and user-friendly banking journey for customers.

Adaptability to all Core Banking Systems

Featuring a channel management module, DoKa streamlines operations, covering all essential digital channels that financial institutions require.

Make DoKa Your Preferred Choice For a Reliable and Versatile Solution

DoKa provides a win-win solution for your clients and your company.

- End-user experience will upgrade to a new level with enchanced UX and UI. Customization of menu in mobile app, alligned OMNI channel digital experience will improve your end-user customer satisfaction scores

- Single Vendor will ease the infrastructure and architechtural costs that you bear as a company

- Adaptability and agility in implementation will shorten implementation time of your new ideas in the pipeline

- Compliance with high security standarts will ease internal and external audit processes